How many times have we heard not to put all of our eggs in one basket? We’ve been taught that idea since we were children, even if we didn’t know it. Don’t play just one sport, have many friends, and focus on many subjects in school. Most often this strategy is sound. Especially as adults, we know that this certainly is true when it comes to investing. We need diversification.

But, I would like to present a challenge to you today and turn this mantra up-side-down. I want you to put all of your eggs in one basket. I would like to show you how focusing on one thing (going small) can help sharpen your focus and lead you towards financial success.

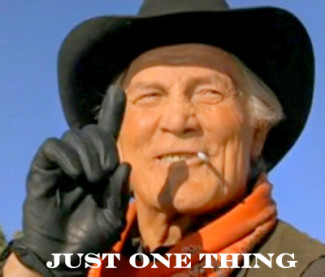

I recently read a wonderful book called “The One Thing. ” This book, written by Gary Keller and Jay Papasan, challenges our multi-tasked way of life. The authors state that we lose productivity, and ultimately suffer, when we multi-task ( or at least from too much multi-tasking).

As a holistic, fee-only advisor, this may sound counter-intuitive to my approach, but it really isn’t. While I’m always looking at the big picture for my clients, we have to focus on certain areas that allow us to succeed.

The authors’ idea is to create focus. Their mantra of “ what’s the one thing I can do such by doing it everything else will be easier or unnecessary” is a great tool in our financial planning world. If we can focus on the one thing to help us reach our goal, while still staying in tact with the big picture, we will increase our chance of success.

For example, if you want to save $1000 in 4 months, you will need to save $250 a month. Simply savings the $250 a month might be your one thing. Do whatever you need to do first to save $250 a month. While this simple example may sound petty to some, it’s the concept that matters. This is also a very simple example, and most folk’s financial plan is very complex. I will caution you that finding your one thing may be difficult. It’s also important to make sure your one thing is the right one thing. I often see prospective clients who have been asking the wrong questions and focusing on the wrong areas….they are focusing on the wrong “one thing.”

I should also note that Mr. Keller and Mr Papasan do feel that the one thing can apply to many different areas. In their book they apply the concept to career, health, faith, family and friends, as examples.

Remember, I’m a firm believer in the idea that there are three things we can control that ultimately lead us to financial success: how much we spend, how much we save, and how much we pay in taxes. We could take “The One Thing” concept to each of these items. This may really sharpen our focus and accelerate our success.

The next time you get the urge to go big I would encourage you to shift your focus and go small. Ask yourself if you are focusing on the right “one thing.” This is a great conversation to have with your advisor, as well. So, go ahead and putt all your eggs in your “one thing” basket. Give it a try, and let me know how it works for you.